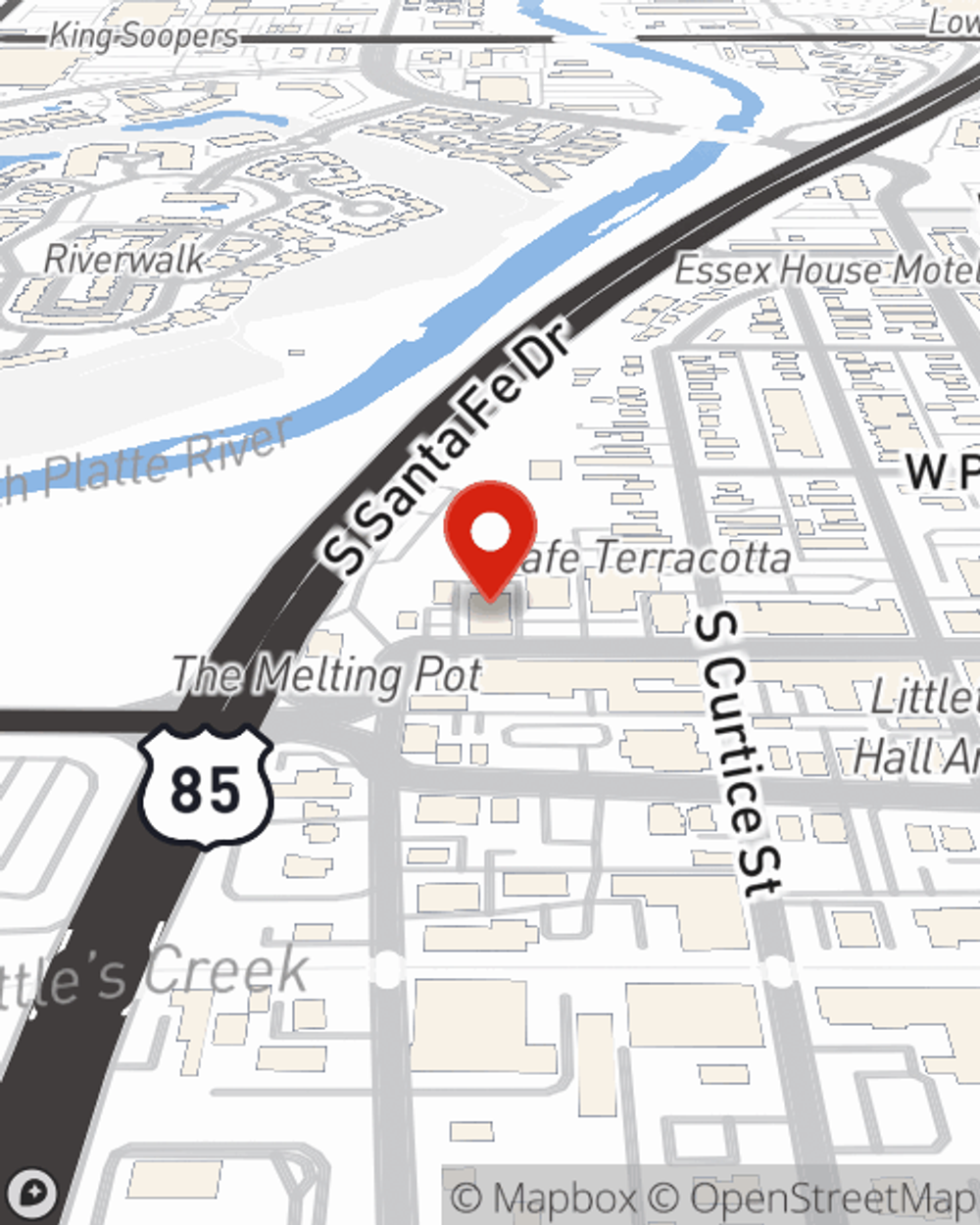

Renters Insurance in and around Littleton

Littleton renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Denver

- Englewood

- Centennial

- Highlands Ranch

- Arvada

- Aurora

- Castle Rock

- Castle Pines

- Wheat Ridge

- Westminster

- Golden

- Parker

- Commerce City

- Evergreen

- Morrison

- Conifer

- Bailey

- Breckenridge

- Vail

Protecting What You Own In Your Rental Home

Your personal items and belongings have both sentimental and monetary value. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your couch to your boots. Not sure how much insurance you need? That's alright! Katie Riley wants to help you evaluate your risks and help find insurance that is reliable and a good fit today.

Littleton renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Why Renters In Littleton Choose State Farm

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Katie Riley can help you with a plan for when the unanticipated, like a water leak or a fire, affects your personal belongings.

There's no better time than the present! Contact Katie Riley's office today to discuss your coverage options.

Have More Questions About Renters Insurance?

Call Katie at (303) 798-8880 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Katie Riley

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.